Written by Shane Balkham.

Many lives have been lost and many words have been written about the terrible war in Ukraine. The conflict has been unpredictable and will continue to wreak havoc on humanity and economies. Uncertainty willcontinue. Russia’s advance is struggling, facing military supply-chain issues, as well as a determined and formidable Ukraine resistance. Sanctions are working and yet it would be foolhardy to predict the outcome of this conflict.

However, whilst the war in Ukraine is quite rightly taking up all the headlines, it is equally important not to be distracted away from other important issues that could affect your investments.

Before Putin made the unfathomable decision to invade its neighbour, the focus for 2022 was the change in monetary environment. For the past two years, the world had deployed a staggering level of economic stimulus to combat the COVID-19 pandemic. It had largely been a success, avoiding the very worst of the doomsday scenarios that were being published in spring 2020. However, the seriousness of the threat from the virus has largely dissipated and the need for emergency conditions no longer exists.

The most significant threat was now inflation, which naturally spiked through an increase in the money supply, as well as increased consumer demand and a constraint on supply. Demand was at high levels due to the boosted level of savings that was accrued during lockdowns and supply was stymied because of the lockdowns. That puts an upward pressure on prices and decade high levels of inflation were the natural outcome.

In order to tackle the high levels of inflation, central banks around the world started to withdraw the accommodative monetary conditions. This is primarily achieved by slowing and stopping its quantitative easing programmes (money printing for the most useful analogy), then starting to increase the level of interest rates. This should soften demand at the same time supply blockages ease.

The most important central bank is the Federal Reserve and throughout 2021 it argued that inflation was transitory and took a more relaxed approach to turning off its stimulus.

However, that ended abruptly in December 2021, when it acknowledged the seriousness of the inflation problem and announced that interest rates would be increasing in 2022.

This was the catalyst for markets to move away from those sectors and stocks that had done well in the pandemic, to those that should do well in an interest rate rising environment. Simplistically, you could say it was a move away from expensive growth and towards those sector and stocks with fairer valuations.

It also started a forecasting leap-frog, with predictions for the number of rate hikes in 2022. Initially forecasts stood at three rate hikes from the Federal Reserve, but quickly rose to an enthusiastic eight. Pressure was mounting the US central bank and it announced that interest rates would be raised at the next meeting in March. All focus was geared around the next six weeks and the expectations for a clear roadmap of forward guidance around rates.

Then Russia invaded Ukraine.

This has generated a smokescreen for the headlines and also created a problem for the Federal Reserve and other central banks around the world. Despite the atrocities being conducted against Ukraine, the inflationary problem still exists and could arguably get worse.

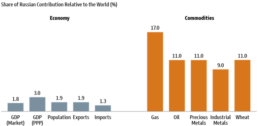

Although Russia’s share of world growth is negligible, its share of commodities is not. The significant role that Russia plays in world commodities may constrain an already tight supply, which would put upward pressure on prices.

Source: Haver Analytics and Goldman Sachs Global Investment Research

Energy prices have already risen sharply, and it will be important to monitor how that affects consumer confidence. As previously mentioned, consumers do have a level of increased savings, accumulated over the pandemic, which could help cushion some of the hit from higher energy prices. There will be pressure on governments to help alleviate the squeeze on incomes, especially as price controls lapse. If energy prices stay this high then it could create a drag on global growth, particularly in Europe where gas prices have risen more significantly than in the US.

Inflation has been forecast to peak around April and May, which will undoubtedly create uncertainty and see volatility spike. It will be natural to extrapolate this data to create worse case scenarios, exacerbated by the war and struggling supply chains. We expect central banks to remain vigilant and continue on the path of raising interest rates, albeit at a more subdued level.

Everything is connected, that was obvious during the lockdowns in the past two years. The war in Ukraine is also connected and we must not forget about the wider implications and that is why we are monitoring the rhetoric coming from the voting members of the Federal Reserve. Next week will be a volatile week, if not for markets, then definitely for news flow and headlines.

The journey of long-term investing will undoubtedly trigger many conflicting emotions and we are here to help guide you through these, to become better investors. Staying invested for the long-term tends to be the best course of action and during times of heightened stress and volatility, there will naturally be the temptation to disinvest, with the intention of reinvesting at a later stage.

We have created an online video presentation to explain the risks associated with long-term investing, which we hope you will find comforting in times of tension and anxiety.