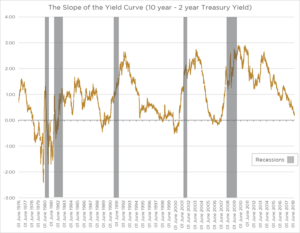

The yield curve is a line that plots the yields of a series of bonds having equal credit quality but different maturity dates. Normally, we would expect the line to rise over time as investors expect higher yields to compensate for the risk in being invested for longer. However, a fall in the long-dated Treasury yields last week flattened the yield curve, narrowing the spread between 2-year and 10-year bills to only 20 basis points; its tightest since 2007, before the financial crisis.

The yield curve is generally indicative of future interest rates and an economy’s expansion. However, short-term yields have been rising quickly recently in response to the Federal Reserve’s actual and planned interest rate rises and the normalization of monetary policy. A flattening yield curve is characteristic of a late-cycle economy and despite the Trump administration’s tax cuts, the bond market is suggesting growth is stalling. An inverted yield curve, where short-term yields trade above long-term yields, is seen as a sign of recession and this has been true for every recession in the US for the past 60 years. However, the timing of the subsequent recession is unknown, being anything up to two years away, as was the case when the yield curve inverted in December 2005.

The US stock market, nevertheless, continues to extend its gains amid the growing threat of trade wars, with the S&P 500 Index reaching a new high last week; this now marks the longest bull run in American stock market history.

On this side of the Atlantic, sterling has fallen further against the euro as the Government unveiled contingency plans for a ‘no-deal’ Brexit. Chancellor, Philip Hammond, suggested that leaving the EU without a deal could result in UK GDP falling by 7.7% over 15 years and that borrowing would be £80bn a year higher. Theresa May, however, rebuffed the comments saying that his figures were out of date. Yet, there was some good news on the Government’s finances which showed a surplus of £2bn last month, double the figure of one year ago, and borrowing in the period from April to July falling by 40% to its lowest since 2002.