Beaufort Investment is Highly Commended at Money Marketing Awards 2020

We are over the moon that Beaufort Investment was ‘Highly Commended’ in this year’s Money Marketing Awards for Best Discretionary Fund Manager. A huge congratulations to all this year’s winners!

Beaufort Investment streamlines ethical range to support changing demand

PRESS RELEASE

Beaufort Investment streamlines ethical range to support changing demand

05 February 2020

Beaufort Investment, a leading discretionary fund management firm, has streamlined its ethical range of model portfolios to make it easier for clients to find the right solution for them.

Beaufort Investment first launched ethical portfolios in 2015 to provide clients with strategies which combined socially responsible, ethical and environmental considerations. Five years on, the firm has now taken the decision to streamline its offering with a view of providing greater simplicity for those wanting to take an ethical approach. It is moving from 10 to 3 risk profiles to reflect the risk return outcomes and now offers three core ethical products, providing a Cautious, Balanced and Growth option.

In addition to being independently monitored for consistency in their ethical and environmental credentials, all funds in the range undergo Beaufort Investment’s rigorous research and fund selection process.

Shane Balkham, Chief Investment Officer at Beaufort Investment commented: “The ever-increasing focus on ethical issues has changed the landscape exponentially over the past few years, and our portfolios have been gaining encouraging momentum since we first entered the market.

“However, the amount of choice on offer has never been greater, and this can be a double-edged sword. Whilst it is a positive step forward for the industry in general, varying interpretations around what ‘ethical’ actually represents have made this an ever-more complex area of investing.

“Having engaged with our clients, it was clear that people value choice when it comes to investing ethically, but also want simplicity so they can identify the options that best suit their values, as well as attitudes to risk and return.

“What’s always been important to us is having a clear mandate in place that enables investors to understand where and how their money is being invested – this new range is designed to do exactly that.”

The move to streamline the ethical portfolios comes after parent company Beaufort Group recently saw assets under management go through the £1bn mark.

ENDS

A Year of Firsts

Shane Balkham, Chief Investment Officer, features on the front cover of January’s printed edition of Citywire Wealth Manager.

See Shane’s four-page article where he shares his view on last year.

15 Years Exceptional Service

An open, transparent investment process that has continually evolved:

-

Risk profiles to meet all clients' needs

-

Proven skills in strategic & tactical positioning of asset allocation

-

Robust governance and oversight of the investment process

-

Fees are amongst the most competitive in the market

-

Unique fund selection process using 30 metrics

-

Regular seminars, quarterly reviews and monthly factsheets

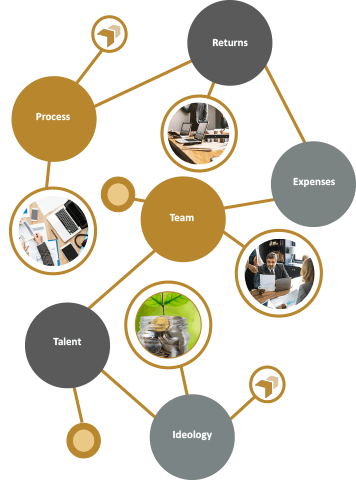

Our unique fund selection process (PRETTI)

For further information, please get in touch with Tony Hicks: 07867 398388 or email us at marketing@beaufortinvestment.co.uk

The World In A Week - Judgement Day

Geopolitical tensions escalated last week following the attack on Saudi Arabia’s oil production facilities. It has been estimated that the attack destroyed c.50% of Saudi production, although there were assured statements from the capital that oil exports would be maintained, and lost capacity would be expediently rebuilt. Following a huge initial jump in the oil price, volatility in the commodity subsided towards the end of last week. However, while the volatility in the oil price subsided, new US sanctions against Iran meant that tensions in the Middle East increased markedly with the US also pledging military support to Saudi Arabia to boost their air and missile defences. Iranian-backed Houthi rebels have claimed responsibility for the drone and missile attacks although Iran denies any involvement. We expect tensions to remain elevated.

The Federal Reserve moved in line with consensus last week, cutting interest rates by 25bps; Trump was quick to lambast Chairman Powell for lacking “guts”. While a twitter outburst from Trump is of little surprise, what is surprising is how the decision to cut interest rates has caused division with the Federal Open Market Committee; seven members voted to cut, two members voted to maintain, and one member voted to cut further. Powell cited that a second cut was necessary due to slowing political growth and worsening trade tensions however, the dissent within the committee will make it more difficult to decipher the trajectory of interest rate policy, resulting in polls for further rate cuts falling from 100% to 80%.

Several weeks ago, we wrote about the suspension of parliament, titled “Prorogue” and in the UK, parliament remains suspended as a result of the invocation of prorogation. In the week ahead, we expect a decision from the Supreme Court over whether Boris Johnson acted unlawfully by suspending parliament; to be clear, this is not about Brexit, it is a legal argument. After all, there is no one place where all the rules of government are written down, which means the Supreme Court must decide between the competing legal arguments, providing a stress-test of another kind, that of our unwritten constitution.

The World In A Week - Getting Our Priorities Straight

The UK Supreme Court ruled that the prorogation of Parliament by Boris Johnson was unlawful, which resulted in a swift restarting of Parliament last week. It would appear the battling forces within British politics are becoming more entrenched and the cross-party support needed to strike a deal with the EU fading. A request to extend the deadline for Article 50 is now most likely, after which we can expect an election or fresh referendum.

Politics escalated even further in the US, with an announcement of the start of an impeachment enquiry into the actions of President Trump. This is centred around a telephone call with President Zelensky of Ukraine, in which it is alleged that Trump asked for an investigation into the activities of the son of Joe Biden, who just happens to be one of the front runners for next year’s Presidential election.

The process is as much political as it is legal, with proceedings needing to pass through both the House and the Senate; the latter being controlled by the Republicans, with a two-thirds majority. It is worth remembering that a President has never actually been impeached; although it was a close shave for President Nixon, who resigned before Congress could vote him out of office.

So, with global data suggesting that growth is slowly dissipating and in much need of both fiscal and monetary stimulus, the governments either side of the Atlantic seem to currently prefer the distraction of playing politics.