The World in A week – Jeans On

Last Wednesday the US Securities and Exchange Commission (SEC) received an Initial Public Offering (IPO) filing from Levi Strauss & Co, the US clothing manufacturer, to re-list on the New York Stock Exchange (NYSE). The 145 year old firm first went public in 1971 and in 1985 the Strauss family effected a Leveraged-Buy-Out to take the firm private again. Now, after 34 years, the firm has chosen to go public once again. At this stage, the filing is still to be declared ‘effective’ by the SEC but, if approved, the IPO plans to raise an additional USD 100 million for the firm’s capital structure.

As investors what do IPOs signify for us?

The volume and size of IPO execution is an indicator of the confidence firms, investors and banks have in equity markets. Firms that are considering floating need the confidence they are listing in a favourable climate of uptrending equity markets with a normal level of volatility. If the market is not like this then the issuance itself risks not being filled nor happening at all as potential investors will either feel the offer is priced incorrectly, due to the volatility, or the upside is lacking in the secondary market. For this reason, the vast majority of IPOs occur in sanguine equity market conditions. It is known for some firms to still float in downturns but only a few. An example of this is in 2016 there were 105 US IPOs, in 2017 there were 160 and in 2018 there were 190 (although Q4 was a comparatively light period) but in the global recession of 2008, for example, there were only 31 US IPOs executed.

Currently, there are 165 outstanding US IPO filings for the NYSE and Nasdaq exchanges. Most will have been filed in 2018 but the amount outstanding is an indicator of the confidence investors have in the US equity markets. It’s important to note however this will not be the final tally for 2019 as, just like Levi Strauss, more will be filed throughout the year. It’s also important to be aware not all of these 165 will actually list either as some will be cancelled, postponed or even not approved by the SEC. But as far as indicators of US equity markets go, this is a positive indicator for the year ahead, although we might expect the final total to be down on 2018 to a certain extent.

Regarding the main markets last week, it was generally a positive week for risk assets. The FTSE 100 rose 1.79% and GBP rose 0.14% against the USD.

The World In A Week - Central Bankers Pause for Thought

This week global markets started to recover from an agitated final quarter of 2018 by inching upwards. The MSCI All Country World Index posted a gain (+1.14%), primarily led by the United States’ stock markets which also recorded a gain (+1.88% as measured by MSCI USA). A similar picture was also reflected in equity returns in Europe and the Emerging Markets who also recorded gains (+0.26% and +0.29% respectively as measured by MSCI).

Fixed Income also staged a comeback. The Bloomberg Barclays Global Aggregate Index returned +0.91%, and High-Yield Bonds returned +1.09% as measured by Bank of America Global High Yield Index. (All figures cited are in GBP)

In light of the apparent rebound, the world’s Central Bankers are now backtracking from monetary tightening. The most striking reversal was made by Federal Reserve Chairman Jay Powell on the 30th of January, where he announced he would stop further interest rate rises due to slowing global growth and inflation expectations.

Powell’s U-turn was closely followed by the Governor of the Reserve Bank of Australia, who announced that interest rates would be moving down, rather than up. The Governor went on to reference the ongoing trade war between America and China as a risk to Australia.

Australia is unique having experienced an unprecedented 25 years of uninterrupted economic growth. However with a frothy housing market and slowing demand for the commodities it sends north, many economists speculate that this streak may soon come to an end.

On Wednesday this week the reversal theme extended to the Emerging Markets with the Reserve Bank of India cutting rates by 25 basis points. Many speculate that Governor Shaktikanta Das was put under pressure to stimulate the economy by Prime Minister Narendra Modi – drawing a parallel with the pressure President Trump put on Governor Powell to ensure “his” economic expansion continues.

On the same day and closer to home, the Bank of England lowered its forecast for UK economic growth this year from +1.7% to +1.2% - citing Brexit uncertainty and the slowing global economic environment. Governor Carney also signalled that UK interests rates would remain on hold, despite constrained inflation expectations and a tight labour market.

Given the week’s events, we believe the uncertain economic environment continues to validate our decision to move to neutral on equity risk across our model portfolio range.

The World In A Week - A Sisyphean Task

Welcome to the new title of our weekly publication – ‘The World In A Week’. This replaces our previous ‘Windy’ title as it better describes what we are researching and publishing. The content will remain the same and this week we are focusing on ‘A Sisyphean Task’

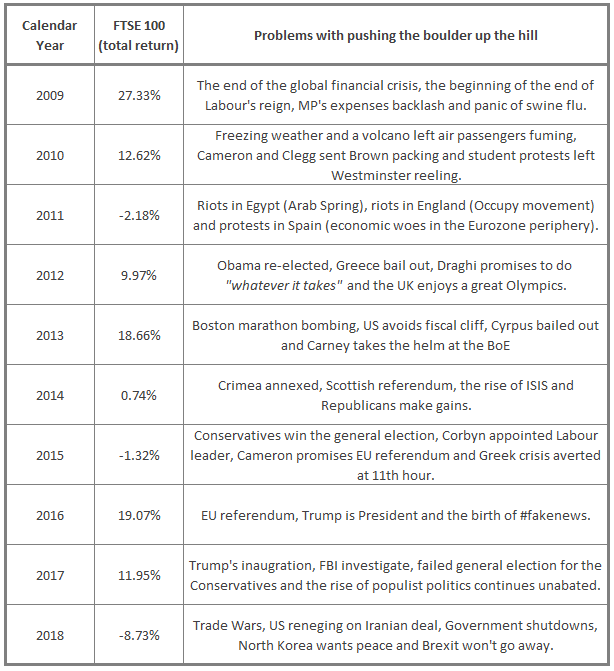

King Sisyphus as punishment for believing himself smarter than Zeus was forced to roll a huge boulder up a hill each day, hampered every step of the way by winged demons, only for it to return to the bottom each morning.

Politicians are showing themselves to be modern day Sisyphus’, thinking they are smarter than they are, trying to make deals when there are no more deals to be made. Their boulder can be characterised as Brexit or the US Government shut downs, their winged demons are the opposition parties and our punishment is to watch the futile battle of gradient versus gravity depicted as the infamous can forever being kicked down the road.

The closure of the US government

The effects of the record-breaking US government shutdown has already rippled through the US economy, adding to the woes of companies already scarred by a slowing economy, ongoing trade disputes and a turbulent stock market.

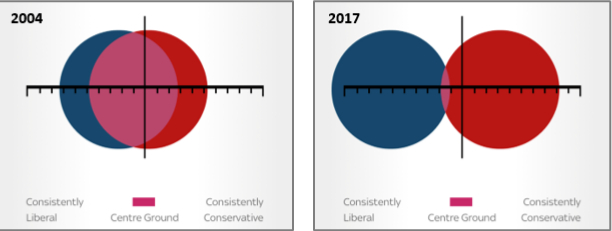

It stems from the Republicans and the Democrats trying to agree the funding extension of the US budget. Agreement was made before Christmas; however, President Trump threw in a curve ball demanding funding for his wall to be included. An agreement could not be reached, which forced a sizeable portion of the US government to be shutdown. This standoff lasted 35 days and has only been given a short repeal for three weeks. Why the trouble to find a centre ground? From the charts below, in 2004, both parties shared a large centre ground, arguably brought about from the aftermath of the terrorist attacks in 2001. Since then the parties have moved steadily apart and the polar views have never been wider.

So, it comes as no shock that a deal is struggling to be made between the two parties and that boulder keeps being pushed up the hill, only to end up right where it started.

Trying to agree on Brexit

Roll the boulder up the hill. Let it fall. Put forward a deal for Brexit. Let it fail. Last week Parliament could not decide, so it left the Prime Minister backing an amendment that rejected the deal she had previously negotiated, a deal that was the final deal, and go try a bit harder. This promise of renegotiating the Withdrawal Agreement, something that was impossible a couple of weeks ago and made more so by the EU rejecting further negotiations, does this create a new definition of futile?

The boulder in this tale is Jeremy Corbyn, looking to delay the decision at every step, without knowing what that would achieve.

The legally binding agreement to extend Article 50 failed, so a non-binding version was passed. Parliament has said it does not want a ‘no deal’ but refuses to take the option off the table. The government backed an amendment and would like to find alternative arrangements; however, apart from yet to be identified new technological solution, nobody knows what the alterative arrangement should be.

Has there always been a boulder?

We have always had politics, politicians and policymakers to worry about. The only certainty is that we will always have uncertainty. What does that mean for investments? Should we not invest? Absolutely not. It does mean we should invest on fundamentals and most importantly for the long-term. We can be cognisant of political ineptitude but not let it drive our decision making.

Beaufort Analysis No. 314 - Groundhog Day

While it’s not quite Groundhog Day yet, it certainly feels like it. Last Monday supposedly marked the most depressing day of the year, when quite coincidentally, Brexit was very much the subject du jour. While there was little to speak of following May’s address to the House of Commons, whilst she ruled out a second referendum she is very much still pushing plan A and hinted she would be more “flexible” in how the government engage with Parliament going forward.

The World Economic Forum took place in Davos last week with several key leaders missing from the line-up. Trump, Jinping, Putin and May were all absent, leaving the atmosphere flat. Key themes at the forum were the future of globalisation and of work in a robotic age with world leaders defending free markets and multi-lateral institutions. All in all, there was little of note.

In the US, the government remained partially shut down at US market close. The US Senate failed to pass two bills to reopen government, continuing its stint as the longest shutdown in US history. While there was some movement on negotiations, Democrats expressed a willingness to increase border control spending, they refuse to contemplate funding for Trumps wall. An 11th hour funding package was signed in to law on Sunday, which will allow some parts of US government to reopen for 3 weeks, which will end on 15th February.

The Bank of Japan (BoJ) and the European Central Bank (ECB) met last week to discuss increasing interest rates; there was no change. The BoJ has the most accommodative monetary policy of all the key central banks around the globe and shows no signs of reducing liquidity or increasing interest rates. The ECB on the other hand is a little further down the road of normalisation, having ceased there quantitative easing program at the end of 2018.

Friday marked key data releases from Europe. Momentum clearly shows signs of weakening with PMI data coming in below expectations. Germany and France, key contributors to the Eurozone PMI, delivered sub-par data in the services and manufacturing sectors respectively. France’ reading fell below the expansionary territory of 50 to 47.5, its lowest in 5-years and German manufacturing fell marginally below 50, its lowest in 4-years.

Beaufort Analysis No. 313 - Are the banks in good health?

Last week the biggest US banks reported solid fourth quarter earnings with most improving on the third quarter and beating analysts’ expectations too.

This resulted in both Goldman Sachs and Bank of America’s shares jumping by 9% and 7% respectively on Wednesday. Citigroup’s shares climbed 4% on Monday, Morgan Stanley increased 1% on Thursday and JP Morgan’s stock rose slightly as well on Tuesday.

Despite Wells Fargo beating earnings expectations, it was behind on revenue estimates and it also announced it will have to continue to operate under the Federal Reserve’s growth restrictions for the rest of 2019 (These are restrictions related to the sales malpractice discovered in 2016). As a result, Wells Fargo’s shares fell by nearly 3% on Tuesday.

For 2018 as a whole, these six banks earned USD 120.2 billion in net income. Not only does this dwarf their 2017 earnings, but it also reflects the strength of the US economy and the confidence equity investors have in the US banking sector.

Although these earnings are impressive, as investors we should also be mindful how resilient the sector is as well.

The best way to assess this is to refer to the central banks’ latest stress-test results. Such processes test various potential adverse scenarios to evaluate if the banks can survive and continue to lend if so impacted.

The Federal Reserve conducted the first stress-tests in 2009 and at that time 10 of the 19 banks failed. Since then they have conducted annual stress-tests for both US and foreign banks operating in the US and in 2018 only one bank failed, which was Deutsche Bank’s US division.

The European Central Bank (ECB) started its stress-tests in 2010 and at that time 7 of the 90 banks that were tested failed. In the latest round of ECB stress-tests, reported in November 2018, all of the banks passed.

The Bank Of England’s latest stress-test report, issued in November 2018, also concluded no UK bank failures.

The results for US, UK and European banks do contrast with the stress-tests conducted on Chinese banks, however. In 2017 the IMF conducted tests on 33 Chinese banks and 27 were found at the time to be under-capitalized by at least one measure. The IMF did pass all of China’s biggest 4 banks, however: The Industrial and Commercial Bank of China, China Construction Bank, Bank of China and the Agricultural Bank of China. The People’s Bank of China (PBoC) has subsequently reported in their Financial Stability Report the reliability of the Chinese financial system since 2017. They reported enhancements to the financial system and that financial operations were generally stable now.

We look forward to the IMF’s next Chinese stress-test results but, judging by the unique efforts since 2008, it is reassuring to know that last week’s US banking results are as sound as they are rewarding.

Regarding the main markets last week, it was generally a positive week for risk assets. The FTSE 100 rose 0.7% and GBP rose 0.5% against the USD and also 0.6% against the IMF’s chosen basket of currencies - the XDR. Brent crude increased by 1.7% and gold, a preferred risk-off asset, slipped by 0.5%. The US 2 yr / 10 yr Treasury spread widened by 0.02% which although is a very small amount the recent trend had been a continual narrowing but this small reversal implies the US Treasury market improved its sentiment slightly as well.

Beaufort Analysis No. 312 – Charging into the New Year

After a tumultuous December, investors started 2019 cautiously. Global economic data pointed to a slowdown amid tighter financial conditions in the US. After the new year’s first full week of trading, markets appeared to have regained some of their vigour. Firstly, the MSCI All Country World Index went on a run of positive performance, cumulating in a +7.8% return in GBP terms since the lows of Christmas Day. Secondly, global growth equities outperformed value stocks by +8.3% vs. +7.3% over the same period, while US equities led the global charge relative to their European peers +9.8% vs. +3.8% in GBP terms, all measured by their respective MSCI indices.

The reversal in sentiment suggests investors were too pessimistic in December, and that they over reacted to economic news flow. It is likely that the Federal Reserve will now slow down the rate of monetary tightening in the US, providing a headwind to markets. Chairman Powell indicated that the central bank was willing to be patient in its desire to raise the Federal Funds rate and in the reduction in the size of its balance sheet; this was clearly influenced by the market sell-off in December. The degree to which policymakers are monitoring equity market movements was articulated by James Grant, Editor of Grant’s Interest Rate Observer, who quipped “James Carville’s endlessly repeated witticism about wanting to come back to earth because the bond market bosses everybody around is as dated today as the Clinton presidency. It’s the stock market that a politically ambitious person would choose to become in a second life.”

Other narratives driving market movements include the ongoing trade dispute between the Trump administration and their Chinese counterparts. There is speculation that the US President would be willing to strike a deal with Xi Jinping in order to avoid a new escalation of tariffs in March. This offered some relief for markets, but it is set against a backdrop of slowing world trade. Here certain corners of the global economy are particularly vulnerable. As the Chinese growth engine wobbles, the economies of commodity exporters like Australia and Canada are likely to slow. These countries are also experiencing increasingly heated housing markets and have gone for over 20 years without a banking cycle leading to the shares of their largest lenders coming under pressure in financial markets.

While markets have engaged in reflection and re-pricing following the December selloff, a variety of risks remain and must be navigated with care. Pro-cyclical asset classes may well enjoy positive returns this year, but the charge will need increased support from economic fundamentals in order to be sustained.

Beaufort Analysis No. 311 - Which Direction?

When markets closed for the year last Monday, most investors would have been pleased to see the back of 2018, well, the latter part of it anyway. In their worst performances since the financial crisis in 2008, the FTSE 100 index fell 12.5%, the Dow Jones fell 5.6% and the S&P 500 was down 6.2%; and this is despite registering all-time highs earlier in the year. Elsewhere, Europe’s Stoxx 600 index fell 13% and Japan’s Nikkei fell 12% throughout 2018. The index of the UK’s smaller companies, by capitalisation, the FTSE 250, fell 19.8%, almost registering a bear market. But by far the worst annual performance of the major indices was China’s Shanghai composite index which fell over 25% as a result of Donald Trump’s imposed tariffs, which have latterly started to impact on economic activity. Last Friday most indices rebounded, however overall, December was another volatile month which saw some of the largest daily movements in history.

It is fair to say that the markets are currently struggling to find a direction. Disappointing data from Asia showed that China’s manufacturing is now in contraction and technology-weighted far-eastern indices were affected further after Apple’s shock revenue warning due to weaker Chinese demand, as a result of the slowing economy and strength of the US dollar. Apple, which became the world’s first $1trillion company three months ago, has now lost over 35% of its value.

In December, the Federal Reserve raised US interest rates for the fourth time in 2018, as expected, to a range of 2.25% to 2.5%, and indicated two more hikes this year. However, at a news conference last Friday Chairman Jerome Powell conveyed a more cautionary approach in light of low inflation, weakening economic data and market volatility and Wall Street is now betting that a looming slowdown in economic growth will prevent the Fed from raising interest rates at all this year, with some investors actually thinking a rate cut is more likely. The Dow, already buoyed by better-than-expected jobs data on Friday, increased by a further 2% on the news.

It is expected that some volatility will continue, certainly for the UK, until we have a resolution to the current Brexit impasse and we are clearer on the outcome. However, the UK equity market is cheap in comparison to other stock markets, having underperformed since 2015. Also, President Trump and President Xi Jinping of China have agreed to work together towards a truce on trade. Recent talks resulted in the tariffs on $200bn worth of Chinese goods remaining at 10%, rather than the 25% Trump had originally promised for 1st January, and there is more optimism that the two sides can reach a solution. It remains to be seen where markets will go from here even though we have already sustained a significant fall over the last three months. History has shown good recoveries after negative years and bounces from December declines, however, we remain cautious for the time being and hope for positive news in the coming months.

The World in A Week – Silence is Golden

You wouldn’t be mistaken if you heard tumbleweed last week, with little news of note; even the Trump twitter feed was silent, leading in to what was an incredibly quiet week. It was President’s Day on Monday which meant US equity and bond markets were closed. The FOMC meeting took place mid-week with members of the committee split on further rate hikes in 2019; the word ‘patient’ was used significantly in the minutes. This dovish tone was well received by markets, which rallied on the back of the Federal Reserve’s softer stance on monetary policy.

Tariff negotiations between the US and China continue to make positive progress. Trump shifted his sights to Europe last week engaging in light tariff discourse aimed at car manufacturers. Trump outlined plans to punish the US consumer if they purchased cars from Europe and the EU responded similarly with a tax on European consumers should they buy cars from the US. Japan will quietly be pleased that Trump’s ire is focused on Europe and hope that these discussions will not lead to further tariffs on Japanese car imports and parts.

Brexit negotiations continue, as ever, slowly. There were several resignations from the Conservatives last week, causing Sterling to wobble; one defector commenting that more resignations could follow, narrowing May’s majority and the possibility of another vote an increasing possibility. Fitch, the ratings agency, placed the UK’s AA-rating, a sign of a country's creditworthiness, on negative watch citing “heightened uncertainty over the outcome of the Brexit process.”

Data releases were also muted. The Euro Area composite figure moved up marginally buoyed by a surprise jump in services data which offset the down-trending manufacturing data. Germany’s services and manufacturing data showed the greatest divergence with 55.1 and 47.6, respectively; the gap between the two sectors is the largest since 2009.