Beaufort Analysis 295 - Argentine Tango

As the Turkish lira has struggled in recent weeks, another emerging economy’s currency has been suffering; the Argentine peso. The peso has lost almost half of its value since the start of the year, with a single day drop of 12% last week. In an effort to stabilise their economy, the central bank in Argentina raised interest rates by 15% to 60%, which is the highest interest rate of any central bank globally. This follows President Mauricio Macri asking the International Monetary Fund (IMF) for an early advance on the $50 billion of finance agreed for assistance. The IMF have said that they are considering early release of these funds to minimise any impacts of poor market conditions.

House price growth in the UK carries on slowing. Whilst house prices are still increasing, the rate of growth has declined. Property prices have fallen between July and August, with the housing market slowing noticeably as pressures on households remain elevated. This fall between July and August is the greatest monthly drop since 2012.

As always, the week would not pass without President Donald Trump threatening to withdraw the US from a body or deal. This time it was the World Trade Organisation (WTO). Trump claims that the WTO rules against the US too often and that the agreement the US has with the WTO was, in his words, the worst trade deal ever made. His comments come as the US and Canada held discussions about re-negotiating the current North American Free Trade Agreement (NAFTA) deal. Whilst no agreement has yet been reached between US and Canada, the US and Mexico have reached a new arrangement in the overhaul of their NAFTA deal, which sees stricter rules on Mexican exports of cars into the US. Donald Trump has also recently criticised the US’ trading relationship with the EU, likening them to China. Pound sterling has once again taken a drop after the EU’s chief negotiator, Michel Barnier, made it clear that he did not agree with Theresa May’s Brexit proposal. Boris Johnson also jumped on the bandwagon of criticising Theresa May’s Brexit plans, in his latest newspaper column.

Beaufort Analysis 294 - Ahead of the Curve

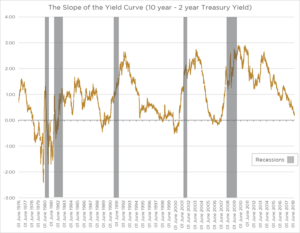

The yield curve is a line that plots the yields of a series of bonds having equal credit quality but different maturity dates. Normally, we would expect the line to rise over time as investors expect higher yields to compensate for the risk in being invested for longer. However, a fall in the long-dated Treasury yields last week flattened the yield curve, narrowing the spread between 2-year and 10-year bills to only 20 basis points; its tightest since 2007, before the financial crisis.

The yield curve is generally indicative of future interest rates and an economy’s expansion. However, short-term yields have been rising quickly recently in response to the Federal Reserve’s actual and planned interest rate rises and the normalization of monetary policy. A flattening yield curve is characteristic of a late-cycle economy and despite the Trump administration’s tax cuts, the bond market is suggesting growth is stalling. An inverted yield curve, where short-term yields trade above long-term yields, is seen as a sign of recession and this has been true for every recession in the US for the past 60 years. However, the timing of the subsequent recession is unknown, being anything up to two years away, as was the case when the yield curve inverted in December 2005.

The US stock market, nevertheless, continues to extend its gains amid the growing threat of trade wars, with the S&P 500 Index reaching a new high last week; this now marks the longest bull run in American stock market history.

On this side of the Atlantic, sterling has fallen further against the euro as the Government unveiled contingency plans for a ‘no-deal’ Brexit. Chancellor, Philip Hammond, suggested that leaving the EU without a deal could result in UK GDP falling by 7.7% over 15 years and that borrowing would be £80bn a year higher. Theresa May, however, rebuffed the comments saying that his figures were out of date. Yet, there was some good news on the Government’s finances which showed a surplus of £2bn last month, double the figure of one year ago, and borrowing in the period from April to July falling by 40% to its lowest since 2002.

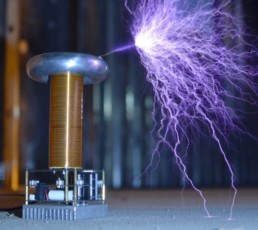

Beaufort Analysis 293 - Tesla re-coil

The Tesla Coil is a transformer designed by Nikola Tesla in 1891 to produce high voltage, low current electricity. In high voltage news, Tesla has been subpoenaed by the US regulator, the Securities and Exchange Commission (SEC) over one of Elon Musk’s recent tweets. The tweet outlined his potential plan to take Tesla private, so the SEC are now investigating for market manipulation as the tweet caused dramatic increases to Tesla’s share price. Musk has confirmed that he has funding from the sovereign wealth fund of Saudi Arabia, but the share price has dropped again after the news of the SEC’s subpoena, which could lead to complications should he move forward with taking Tesla private.

The Turkish lira has been starting to recover since its recent low last week but has still lost over 35% against the dollar year to date. The US treasury secretary, Steve Mnuchin, has continued to advise that the pressure would be increased on Turkey with further sanctions applied if they do not release a detained US national.

Alongside the falling lira, global trade, and the strengthening dollar, emerging markets have taken a tumble last week and have fallen into bear territory. Emerging markets have decreased more than 20% since their high at the end of January, the definition of a bear market. Emerging markets are also a large consumer of commodities, which have also plummeted and is tied to the fall in emerging markets. Within commodities, metals have dropped almost 20% since their peak in April of this year, leading them also nearly into bear territory.

UK inflation increased in July, up to 2.5%, as a result of rising prices for computer games and transport fares. Somewhat ironically with increased transport fares is that rail prices will increase in January 2019 by July’s inflation figure plus 1%. This puts the increase to commuters at an eyewatering 3.5%. This is the first month since last November that inflation has increased. UK unemployment figures were also released last week, hitting the lowest figure of unemployment seen since 1975, at 4%.

Quarterly update from Beaufort Investment

Beaufort Investment’s Head of Portfolio Construction & Research, Shane Balkham speaks to Brian Davies from Beaufort Financial (Westerham) about what’s happened in the markets over the last quarter, and how these changes have affected our portfolios.

Beaufort Analysis 292 - Roasting Turkey

A war with no winners; only varying degrees of losers. That is how the media is describing the trade war being waged by President Trump, under the guise of national security. It is rather ironic then, that Canada recorded one of its best months for foreign trade in the same month that Donald applied steel and aluminium tariffs. The Canadian economy looks set to top 3% annualised growth for the second quarter.

However, it seems that 2018 will be remembered for being the year of ‘tit for tat’. While Canada is enjoying a jump in trade exports, Saudi Arabia has instructed its overseas asset managers to sell Canadian equities, bonds and cash holdings at any cost.

This flexing of financial and political muscle is the chosen method of Saudi Arabia, a warning not to interfere in their affairs and linked directly to Canada’s foreign minister calling for the release of Samar Badawi who was arrested last week in a crackdown against dissenting voices. This spat is not over, and the biggest losers could be the 7,000 Saudi students enrolled in Canadian universities on government-sponsored scholarships.

Troubles are mounting for Iran, with its currency weakening against the US dollar and inflation spiralling, its citizens are struggling with rising food prices and fuel shortages in some of its cities. To add to their woes, Donald Trump has reinstated economic sanctions, that had previously been waived as part of the Iran nuclear deal of 2015. Things only look to get worse in November, when the US will increase the punitive measures by banning Iranian oil exports. President Trump has warned that secondary sanctions will apply to anyone doing business with Iran, so while the rhetoric from EU nations has been a pledge to try and preserve economic ties, it is most likely that European companies will sacrifice trade with Iran, rather than risk additional ire from Donald.

Another country that has a weakening currency and not just to the US dollar, but all currencies including struggling sterling, is Turkey. It too is facing economic sanctions from Mr Trump, after the detention of US pastor Andrew Brunson. The US has imposed sanctions on two Turkish government ministers and threatened to double the tariffs on steel and aluminium imports. This has worsened an already dire currency crisis for Turkey, whose Lira was down over 25% for the week. President Erdogan vowed to find new friends and allies to help them out of this spiral and not succumb to Trump’s economic warmongering.

Wars with no winners indeed.

A tenuous link to lighten the mood; this weekend saw the start of the season of the Premier League, which within its twenty teams has two exports from the above maligned countries. Cenk Tosun of Turkey started in Everton’s draw against Wolves and contributed to an assist for Everton’s second goal. Alireza Jahanbakhsh of Iran started on the bench for Brighton against Watford and his 71st minute appearance could not stop his team succumbing to defeat.

Beaufort Analysis 291 - “An Apple a day keeps the dot coms at bay”

It was a week for focusing on central banks, as we had policy meetings for the Bank of England, Federal Reserve and Bank of Japan. So we ask, as three of the four most influential policy makers (the other being the European Central Bank) converged at a junction last week, what are the signs telling us?

The traffic lights were green for the Bank of England as the Monetary Policy Committee (MPC) raised rates, by a quarter of one percent, to the highest level for more than a decade. This is not without risks, even if the underlying level is as low as 0.75%. Although the MPC voted unanimously in rising interest rates in the UK, the narrative was one of caution, focusing on taming inflation rather than supporting jobs growth, with employment in the UK at a record high. The balancing act is made even tougher with the final shape of Brexit still unknown, with a little over six months until the deadline for leaving the EU.

It was an amber light for the Federal Reserve, with no change to their interest rate, which was fully expected, as the US central bank is nothing but transparent. Four interest rate raises where pencilled in for 2018 and we have seen a rate rise in March and June, with the next firmly scheduled for September. Their meeting last week strengthened the view that two more rate rises are on the cards, as the Fed chose to focus on the strength of the US economy, while deciding to ignore the threat of Trump’s tariffs.

Sitting at the red light is the Bank of Japan, as it continues to maintain its easy policy stance and is arguably the most accommodative of the four major central banks. There are no signs of interest rate rises on the horizon and the meeting served as a reminder of its commitment to maintain its easy monetary policy.

In the race of the tech giants to reach a valuation of a trillion-dollars, Apple was victorious, having reached the landmark point on Thursday. Having reported on earnings earlier in the week, which was above analysts’ expectations, Apple’s share price surpassed $207 taking the market capitalisation of the company above $1,000,000,000,000.

There are grey linings to this silver cloud though; Apple’s fastest growing division is the one most at risk. Accessories, including watches, earphones and speakers, is vulnerable of being caught up in Donald Trump’s latest proposals to slap a 25% tariff on Chinese imports. This would be a lose-lose dilemma for Apple: either rising prices in the US to compensate for higher duties or take a hit to their profit margins.

Beaufort Analysis no. 290 - What goes up must come down

Technology stocks have been a feature of many headlines in the past week. Whilst Facebook experienced losses of 20% on Thursday, Amazon’s quarterly profits hit a record $2.5bn. Facebook announced that revenue growth was slowing, as well as the number of new users not growing as quickly as they have previously. Following the EU’s introduction of the General Data Protection Regulation (GDPR), Facebook has seen a decline in the number of both daily and monthly European Facebook users. Furthermore, the number of US users has remained the same with no growth over the past year, deepening concerns over Facebook’s future and in turn, driving the share price down. Mark Zuckerberg personally lost $20bn in wealth after the share price fell.

Whilst Twitter is not regarded one of the main explosively growing FAANG (Facebook, Amazon, Apple, Netflix, Google) tech stocks, its shares also experienced a sharp drop on Friday after the number of active users has fallen for the social media network. After Amazon reported their above-mentioned record results, the share price grew 4.2% on Thursday last week. Despite the €4.3bn fine recently imposed by the EU, the share price of Alphabet, Google’s parent company, rose by 4% at the beginning of last week. The divergence in performance of these FAANG stocks is starting to grow.

This is definitely not the demise of these tech stocks, but their growth is slowing as demands for services change and evolve over time, with Facebook and Twitter seeing large shifts in their demographics. The industry is seeing a shift from FAANGs to MAGA. Not Trump’s campaign slogan Make America Great Again, but Microsoft, Apple, Google and Amazon. These tech stocks are taking over from the FAANGs as stock market favourites.

US growth was at its fastest rate since 2014 last week, largely due to a surge in consumer spending, but also as farmers are increasing exports of soybeans to China ahead of the tariffs. Other US exports also grew at their fastest rate since 2013 as companies moved forwards to beat the application of tariffs. Talks between the US and EU over trade have also now been resolved, with original tariff threats dropped by the US. The US still have tariffs on steel and aluminium imports, but they are working together towards zero tariff trade.

In the EU, Michel Barnier, the chief Brexit negotiator for the EU, has ruled out Theresa May’s customs proposal of the UK collecting custom taxes on its behalf. He has stated that the EU would not delegate the collection of customs to a non-member. However, he has confirmed that progress has been made with a meeting agreed for mid-August to continue discussions, with a view to a deal in October.

The week ahead is a busy one for central banks, as both the Monetary Policy Committee of the Bank of England, and The Federal Open Market Committee Meeting of the Federal Reserve meet to discuss interest rates.

Beaufort Analysis no. 289 - Wish you were here…?

As the holiday season starts, Britons heading abroad are being hit by the poorest exchange rates for ten months. Last week, the pound briefly dipped below $1.30 for the first time since last September, and an 8-month low against the euro, due to a surprise fall in retail sales in June. The Office for National Statistics (ONS) announced that sales fell 0.5% last month, against a forecast of a 0.2% rise. Shoppers kept away from the high street despite food and drink sales being boosted by the hot weather and the World Cup. Retail sales volumes had grown 1.3% in April and 1.4% in May. The Bank of England had been expected to raise interest rates in August but following the fall, the unchanged inflation figure of 2.4% for June, and wage growth slowing to 2.7%, economists were divided on whether it would do.

The rate fall was also due to the strengthening dollar. US Federal Reserve chair, Jerome Powell, was upbeat in his view of the US economy. This, and solid earnings figures, helped boost US stocks. However, the continuing trade war concerns have kept markets in check and there was no movement over the week on either side of the Atlantic.

Government borrowing for the first three months of this year has fallen to its lowest level since before the financial crisis, and considerably below the Office for Budget Responsibility’s forecast for 2018/19. Public sector net borrowing was £16.8bn between April and June, some £5.4bn lower than the same period last year, and the lowest since 2007. This fall could give Philip Hammond, Chancellor of the Exchequer, room to ease austerity measures in the November budget as he tries to find extra funding for the NHS.

The International Monetary Fund (IMF) said the global economy is on course to grow 3.9% this year and next. This would represent the best back-to-back years of growth since 2010/11 when the world rebounded from the financial crisis. The IMF, however, also noted that growth has become less evenly spread among countries compared to last year.

Beaufort Analysis – No. 288 - It’s Not Coming Home

The most important event affecting the UK economy for the last four weeks has been the football World Cup, with England’s progression in the competition accounting for an estimated £1.6bn in sales for the beleaguered leisure and retail sectors. This figure includes spending on flat-screen TVs, barbecues and the consumption of food and drink during games. It is thought that around £400m was spent during the semi-final alone. While the result was not what most of us wanted, the Bank of England’s chief economist, Andy Haldane, suggested that the rise in consumer spending as a result of the “feel-good factor” could put pressure on the need to raise interest rates, which was postponed in May due to the winter slowdown.

Something else which now seems to be further away from ‘home’ is the Government’s deal on Brexit. Following the cabinet summit at Chequers on 6th July, Theresa May had to accept the resignations of David Davis, the UK’s Brexit secretary, and Boris Johnson, the foreign secretary due to their differing opinions on the Brexit plan; they have been replaced by Dominic Raab and Jeremy Hunt, respectively. Brexiteers, who had previously supported the Government in Commons votes are detailing changes to the Customs Bill with the hope that recalcitrant Conservative MPs, who want closer ties to the EU, are appeased. However, Donald Trump, who was visiting the UK last week for talks with Theresa May, added fuel to the fire by saying that the current Brexit plan would “probably kill any trade deal with the US.” President Trump, critical of the EU and a fan of hard-line trade policies, wants a hard Brexit deal. Nevertheless, talks last Friday afternoon indicated that the two leaders had agreed to pursue an “ambitious” trade deal with President Trump relenting and saying “whatever you do is OK with me” and suggesting that Theresa May should sue the EU rather than negotiate.

Helped by the World Cup, retail spending in June was up 2.3% compared to last year and the UK economy expanded by 0.2% for the three months to the end of May driven by strong growth in the services sector, which more than offset contractions in the manufacturing and construction sectors. With the economy improving and wage growth now outpacing inflation, it looks like the Monetary Policy Committee’s forecast of 0.4% GDP growth for Q2 could be met, with the likelihood of interest rates being raised in August.

UK house prices rose at their slowest pace since March 2013 in the year to June, according to the Halifax, by just 1.8%; and over the last three months, the cost of an average property has actually fallen 0.7%, the largest quarterly decline for over six years. Conversely, house prices across the Eurozone are rising at the fastest rate since before the global financial crisis.

Beaufort Analysis 296 - New highs and new lows...

We are almost three quarters of the way through 2018 and last week was characterised by new highs, new lows and some level of certainty.

Amazon were the second company in US history to break through the $1 trillion market cap last week following in the footsteps of Apple a couple of weeks prior. Despite Amazon closing just below the $1 trillion mark, the achievement of hitting this magic number is more significant, as it did so in just over 20 years; it took Apple almost 40 years. Amazon have a much more diversified product base than Apple which will no doubt have helped them reach the $1 trillion level more quickly.

South Africa fell in to recession in the first half of 2018, following two consecutive quarters of declining GDP growth. This is the country’s first recession since 2009 with declines reported in agriculture, trade and manufacturing in the second quarter of the year. This will pose a challenge to relatively new president, Cyril Ramaphosa, who pledged to revitalise the economy and crackdown on corruption.

There were further losses in currencies last week led by the South African Rand, which fell over 3% following the announcement of the country’s poor economic data; this is the weakest level experienced by the Rand since June 2016. The Argentinian Peso and Turkish Lira also extended their losses in excess of 1% and 0.5%, respectively; an all-time low for the Peso.

A level of certainty was assured by Mark Carney who is now expected to stay at the Bank of England beyond 2020 to provide continuity during the Brexit transition. Carney has been coy about his ongoing tenure at the BoE in the past but firm confirmation of an extension of his leadership is expected in an announcement from the Chancellor, Philip Hammond, later this week.

This coming Saturday marks the 10-year anniversary of the Lehman’s crash which will likely be extensively revisited by the media over the weekend.