Two Minute Missive - 20th November

Watch the latest ‘Two Minute Missive’ from our Client Investment Director, Shane Balkham.

This video contains the opinions and views of Shane Balkham. Please work with your financial planner before undertaking any investments.

The World In A Week - Diversifying your basket

Written by Millan Chauhan

The Bank of England’s Monetary Policy Committee voted narrowly to maintain interest rates at 4%, with five members favouring a hold and four advocating for a cut. Governor Andrew Bailey signalled a commitment to lowering interest rates gradually, noting that inflation appears to have peaked. This has increased expectations for a potential rate reduction at the Committee’s final meeting of the year in December.

Last week, US equity markets experienced declines, with the S&P 500 decreasing by 1.7%, largely due to weakness in technology stocks. The Nasdaq-100, which is heavily weighted toward technology firms, fell by 3.2%. The sell-off was driven by worries about high valuations in these technology companies and a decline in consumer confidence during October. Investment into Artificial Intelligence (AI) has remained strong with major technology companies, including Alphabet, Amazon, Meta, and Google, collectively reporting $112 billion in capital expenditures for the third quarter. These investments are primarily directed toward Graphics Processing Unit (GPU) acquisitions and infrastructure enhancements, which are intended to drive AI integration and improve productivity and efficiency. This sustained commitment has played a significant role in driving up the valuations and prices of these technology companies. This capital expenditure has also positively impacted infrastructure assets, especially electric utilities, which play a crucial role in meeting the rising energy requirements associated with AI hardware.

Historically, infrastructure assets have provided strong diversification benefits compared to global equities, often acting defensively during stock market downturns, while also offering effective inflation protection and an attractive dividend yield. For instance, last week the Nasdaq-100 dropped by 3.2%, but infrastructure assets, as measured by the S&P Global Infrastructure GBP Hedged Index, rose by 0.9%. This clearly demonstrates how portfolio diversification plays a crucial role in achieving positive outcomes.

The United States federal government has now been shut down for 38 days, constituting the longest closure in history. This situation has limited access to official government data and increased reliance on alternative reports from the private sector. For instance, last Wednesday’s ADP employment report indicated that private employers added 42,000 jobs over the past month, representing an improvement after two consecutive months of job losses. However, a separate report released last Thursday by Challenger, Gray & Christmas stated that US employers have announced nearly 1.1 million job cuts year-to-date through October, a 65% increase compared to the same period last year and a 44% rise over the total number of cuts in 2024. In October alone, 153,074 job cuts were reported, marking the highest figure for that month since 2003. These developments present considerable challenges for the Federal Reserve as it assesses the state of the labour market and the broader economy in advance of their final meeting of the year in December. In light of the conflicting economic indicators, markets are assessing whether the Federal Reserve will implement a rate cut next month or maintain current rates amid the continued uncertainty.

Although global markets experienced a downturn last week, we would like to emphasise the advantages of remaining invested, as attempting to time the markets is often extremely challenging.

All performance figures are stated in Sterling terms, unless otherwise specified.

Any opinions stated are honestly held but are not guaranteed and should not be relied upon.

The information contained in this document is not to be regarded as an offer to buy or sell, or the solicitation of any offer to buy or sell, any investments or products.

The content of this document is for information only. It is advisable that you discuss your personal financial circumstances with a financial adviser before undertaking any investments.

All the data contained in the communication is believed to be reliable but may be inaccurate or incomplete. Unless otherwise specified all information is produced as of 10th November 2025.

© 2025 YOU Asset Management. All rights reserved.

Two Minute Missive - 7th November

Watch the latest ‘Two Minute Missive’ from our Client Investment Director, Shane Balkham.

This video contains the opinions and views of Shane Balkham. Please work with your financial planner before undertaking any investments.

The World In A Week - Keep your allies near and your rivals closer

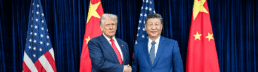

[Image source: White House Gallery]

Written by Ilaria Massei

The event that received the most attention last week was the deal between Donald Trump, President of the United States of America, and Xi Jinping, President of China. They met at the Asia‑Pacific Economic Cooperation Summit 2025 in South Korea and reached a one-year trade deal, with China agreeing to postpone export controls on rare earths (metallic elements essential in smartphones, laptops, electric vehicles and defence equipment) and semiconductors and the US to ease tariffs on shipping and fentanyl-related goods (chemicals, ingredients, and equipment used to make or distribute fentanyl), to improve cooperation with China in controlling the illegal production and flow of fentanyl. Both leaders emphasised a shared vision of “prospering together” in their first such meeting in years. While investors viewed the agreement as potentially temporary, it was warmly welcomed by markets eager for stability - freeing global equity markets to move higher with the MSCI All Country World Index up + 1.7% over the week.

While equity markets were buoyant, bond markets were more cautious as the Federal Reserve (Fed) delivered an expected 25-basis-point rate cut but Fed Chair, Jerome Powell, tempered expectations, stating that another cut in December is “not a foregone conclusion.” The news was not well received by the US Treasuries market with long-dated Treasuries (as represented by the Bloomberg US Treasury 20+ Years) declining -1.2% in USD on worries that there might not be enough rate cuts in the future to support the economy.

While tariffs and monetary policy dominated US headlines, this week’s earnings announcements provide important context for assessing the health of corporate activity. European banks continued to perform well - with Crédit Agricole & Santander among the standouts - while UK Banks like NatWest reported their highest quarterly profits since 2008. In contrast, US technology firms faced a volatile week as investors struggled to reconcile enthusiasm for AI with concerns about excessive spending. None of Google (Alphabet), Meta, or Microsoft are willing to stop spending on AI yet and together have spent nearly $80 billion last quarter on AI infrastructure. While Alphabet’s shares rose on record revenues and increased capital spending plans for 2025, Meta and Microsoft declined as profits have come under pressure due to increasing costs on AI-related expenses. Hyperscalers - such as Microsoft, Google, and Meta - are the largest cloud and technology companies investing heavily in building and expanding AI infrastructure. Nvidia, on the other hand, is a key supplier to these players, providing the advanced graphics processing units (GPUs) and hardware needed to power AI applications. While hyperscalers are seeing pressure on profits due to their massive capital spending, Nvidia continues to benefit as long as this investment cycle in AI infrastructure remains strong - at least for now.

During weeks characterised by high news flow and market volatility, we think that adopting a global investment perspective is essential. It enables the identification and capture of opportunities across diverse markets, rather than restricting exposure to a single region.

All performance figures are stated in Sterling terms, unless otherwise specified.

Any opinions stated are honestly held but are not guaranteed and should not be relied upon.

The information contained in this document is not to be regarded as an offer to buy or sell, or the solicitation of any offer to buy or sell, any investments or products.

The content of this document is for information only. It is advisable that you discuss your personal financial circumstances with a financial adviser before undertaking any investments.

All the data contained in the communication is believed to be reliable but may be inaccurate or incomplete. Unless otherwise specified all information is produced as of 3rd November 2025.

© 2025 YOU Asset Management. All rights reserved.

The World In A Week - UK equities shine and the “Takaichi-trade”

Written by Chris Ayton

The MSCI All Country World Index of global equities ended the week up +2.5% and is now up +13.5% this year. In global fixed income markets, the Bloomberg Global Aggregate Index was up +0.1% over the week in GBP Hedged terms and is now up +5.0% in 2025 so far.

The UK equity market enjoyed a strong week, rising +3.2% and is now up a very healthy +20.3% year-to-date. UK economic data releases over the week were generally positive, notably September’s annual inflation reading that came in at 3.8% which was below most expectations and, in some minds, increased the chances that the Bank of England could cut interest rates again before year-end. UK retail sales, a measure of consumer spending, also rose unexpectedly driven by demand for computers and telecommunications and online jewellers reporting strong demand for gold.

Japanese equities also enjoyed a boost from Sanae Takaichi being confirmed as Japan’s first female Prime Minister. It is generally regarded that Takaichi, who wants to be Japan’s “Iron Lady”, will be positive for the Japanese equity market and will be pushing for some additional stimulus to boost defence spending and also help support households feeling the impact of inflation. MSCI Japan was up +2.2% over the week taking the index to +15.4% for the year so far. Commentators are already collectively calling this the “Takaichi-trade” although, even with the new coalition with the Japan Innovation Party in place, it remains to be seen how much of the new spending plans and potential tax cuts she will manage to get through parliament.

After a stellar run, the shine came off gold last week, breaking a nine-week winning streak as trade tensions between the U.S. and China seemingly cooled, easing safe-haven demand. However, the oil price jumped as the US announced sanctions on Russia’s two largest oil companies, Lukoil and Rosneft, which will also likely result in other large importers like China and India curbing their purchases of Russian oil, switching their demand elsewhere. Such politically driven volatility underlines how hard it is to predict short-term commodity prices and this is why in the lower risk YOU funds and portfolios, instead of betting on single commodities, we maintain a broadly diversified exposure to commodities. The wider Bloomberg Commodity Index, which allocates across 24 different commodities, rose +1.7% over the week and is up +12.5% year-to-date, both in GBP hedged terms.

All performance figures are stated in Sterling terms, unless otherwise specified.

Any opinions stated are honestly held but are not guaranteed and should not be relied upon.

The information contained in this document is not to be regarded as an offer to buy or sell, or the solicitation of any offer to buy or sell, any investments or products.

The content of this document is for information only. It is advisable that you discuss your personal financial circumstances with a financial adviser before undertaking any investments.

All the data contained in the communication is believed to be reliable but may be inaccurate or incomplete. Unless otherwise specified all information is produced as of 27th October 2025.

© 2025 YOU Asset Management. All rights reserved.

The World In A Week - There’s never just one cockroach…

Written by Cormac Nevin

The title of this piece refers to an old saying in financial markets, often attributed to Warren Buffett, but employed last week by the CEO of JPMorgan Chase when discussing a string of corporate bankruptcies that rattled credit markets.

The bankruptcies that Jamie Dimon said had “got his antenna up” included First Brands Group - a U.S. auto-parts maker that filed for bankruptcy protection in late September; Tricolor Holdings - a U.S. sub-prime auto-lender and dealership group that entered liquidation in September; and Zions Bancorporation - a U.S. regional bank that announced a US$50 million loan write-off tied to two borrowers who, it said, misrepresented information and pledged collateral improperly.

The problem is simple enough: money has become expensive again. Central banks have been trying to keep policy “restrictive” to ensure inflation stays buried, but that means companies rolling over debt issued during the zero-rate years are now facing vastly higher costs. A business that borrowed at 3% in 2021 might now be staring at 8% or more. That’s manageable if revenues are growing - but many firms are seeing demand soften as consumers tighten their belts and government support fades.

For now, equity markets remain remarkably calm, with the MSCI All Country World Index up +0.5% last week. However, at the margin, these developments make us cautious about the lower-quality end of credit markets. The explosive growth of private credit and private equity activity in these areas has made them substantially more opaque, and the lack of frequent market-based pricing means risks can accumulate before they become widely apparent.

We remain biased towards high-quality sovereign fixed-income assets at this juncture and only employ highly specialised active managers for the modest amount of credit exposure we currently bear.

All performance figures are stated in Sterling terms, unless otherwise specified.

Any opinions stated are honestly held but are not guaranteed and should not be relied upon.

The information contained in this document is not to be regarded as an offer to buy or sell, or the solicitation of any offer to buy or sell, any investments or products.

The content of this document is for information only. It is advisable that you discuss your personal financial circumstances with a financial adviser before undertaking any investments.

All the data contained in the communication is believed to be reliable but may be inaccurate or incomplete. Unless otherwise specified all information is produced as of 20th October 2025.

© 2025 YOU Asset Management. All rights reserved.

The World In A Week - Looking beyond short-term volatility

Written by Ashwin Gurung

Japanese equities gained over the week after Sanae Takaichi won the Liberal Democratic Party (LDP) leadership election, with the MSCI Japan Index up +2.8% in local currency terms as investors reacted positively to her likely appointment as Japan’s next prime minister and her plans to support the economy through increased government spending, tax cuts, and subsidies. The Japanese yen, meanwhile, weakened -1.6% over the week vs GBP, this offset most of the local currency gain for GBP-based investors, resulting in a modest return of +0.7% for the MSCI Japan index.

However, further uncertainty emerged after markets closed on Friday, when the LDP’s long-standing coalition partner announced they were leaving the coalition, citing policy disagreements and concerns over a previous funding scandal. This has created short-term political uncertainty and prompted speculation about a possible snap election. While we stay abreast of market developments, we do not base our investment decisions on political outcomes. We believe that the ongoing corporate governance reforms and resilient consumer demand in Japan continue to support our positive long-term view.

In the US, equities were weighed down by renewed concerns over trade tensions with China and the ongoing government shutdown. Investors became more cautious after President Trump suggested the possibility of additional tariffs of 100% on Chinese products in response to China’s new export controls on rare earths, which are key materials used in electronics and clean energy, adding to existing geopolitical uncertainty. This increased volatility in US and Chinese equities, and drove demand for safe-haven assets like US Treasuries and gold. The S&P 500 and MSCI China indices fell -1.2% and 2.1%, respectively, over the week, but our long-dated US Treasury exposure performed well, returning +1.4% and providing effective diversification for our portfolios.

Across Europe, political turmoil in France and ongoing trade tensions weighed on market sentiment towards the end of the week. A drop in German industrial output also raised recession worries, with the MSCI Europe ex-UK index falling -1.4%. Meanwhile in the UK, housing markets slowed in September, with prices and buyer demand remaining soft. Higher borrowing costs, ongoing inflation, and worries about possible tax rises ahead of the November budget all contributed to the weaker sentiment.

This year continues to highlight the importance of a well-diversified portfolio amid ongoing uncertainty, not just across different geographies but also across a range of asset classes and investment styles. We remain aware of market developments but remain focused on our long-term view.

All performance figures are stated in Sterling terms, unless otherwise specified.

Any opinions stated are honestly held but are not guaranteed and should not be relied upon.

The information contained in this document is not to be regarded as an offer to buy or sell, or the solicitation of any offer to buy or sell, any investments or products.

The content of this document is for information only. It is advisable that you discuss your personal financial circumstances with a financial adviser before undertaking any investments.

All the data contained in the communication is believed to be reliable but may be inaccurate or incomplete. Unless otherwise specified all information is produced as of 13th October 2025.

© 2025 YOU Asset Management. All rights reserved.

Two Minute Missive - 8th October

Watch the latest ‘Two Minute Missive’ from our Client Investment Director, Shane Balkham.

This video contains the opinions and views of Shane Balkham. Please work with your financial planner before undertaking any investments.

The World In A Week - Continued gains on AI optimism and rate cut expectations

Written by Dominic Williams

Global equity markets moved higher last week, with the MSCI All Country World Index rising by +1.2%, supported by growing expectations that the US Federal Reserve could continue cutting interest rates after its first move of 2025 last month. Technology stocks also provided a lift, as optimism around artificial intelligence continued to drive investor sentiment.

In the UK, the economic picture remained mixed. Consumer borrowing grew at its fastest pace in almost a year, suggesting households are still willing to spend, even as credit card borrowing eased slightly compared to the previous month. Political attention centred on the Labour Party conference, where Chancellor Rachel Reeves reaffirmed her commitment to fiscal discipline and maintaining market confidence. Despite the debate around government borrowing, UK equities performed well, with the FTSE All Share posting solid gains, up +2.3% over the week, with the more domestically focused FTSE 250 gaining +2.5%. We continue to see opportunities in the UK market, which remains attractively valued compared to many international peers.

Japan had a steadier week, with markets holding near record highs, the MSCI Japan gained +0.4%. Growth-focused companies outperformed, particularly in the technology sector, as enthusiasm for AI-related businesses spilled over from global markets, following OpenAI’s $6.6 billion share sale, which valued the firm at $500 billion. The recent leadership election brought a historic moment, with Sanae Takaichi becoming Japan’s first female prime minister. While this is a significant political milestone, we believe the long-term drivers of Japan’s market, such as corporate governance reforms and improving capital efficiency, remain the key reasons for our positive outlook.

In the US, markets showed resilience despite the start of a government shutdown, which delayed the release of official employment data. Investors instead focused on private sector reports that pointed to a softer labour market, reinforcing expectations for interest rate cuts in the months ahead. The S&P 500 ended the week higher, gaining +0.6%, reflecting confidence that monetary policy will become more supportive.

Overall, the week highlighted a balance between optimism about easier monetary policy and caution over political and fiscal risks. In this environment, maintaining a diversified and disciplined investment approach remains the most effective way to navigate uncertainty.

All performance figures are stated in Sterling terms, unless otherwise specified.

Any opinions stated are honestly held but are not guaranteed and should not be relied upon.

The information contained in this document is not to be regarded as an offer to buy or sell, or the solicitation of any offer to buy or sell, any investments or products.

The content of this document is for information only. It is advisable that you discuss your personal financial circumstances with a financial adviser before undertaking any investments.

All the data contained in the communication is believed to be reliable but may be inaccurate or incomplete. Unless otherwise specified all information is produced as of 6th October 2025.

© 2025 YOU Asset Management. All rights reserved.

The World In A Week - US government reopens but volatility rises as tech weakens

Written by Dominic Williams

Global equity markets ended the week on a subdued note, with the MSCI All Country World Index edging up +0.5%, as investors rotated out of AI-driven tech stocks, triggering sector-specific selling. Volatility was amplified by the US government’s reopening after its record 43-day shutdown. Mixed economic data across regions curbed enthusiasm and prompted investors to dial back exposure to technology and other fast-growing companies, which have seen strong gains.

In the UK, the economic outlook remained lacklustre ahead of Chancellor Rachel Reeves' Autumn Budget on 26 November. Revised official figures confirmed Q3 GDP growth of only +0.1% quarter-on-quarter, coming in below the +0.2% consensus forecast. This followed flat output in August and a contraction in September, in part due to disruptions like the cyber-attack on Jaguar Land Rover that curtailed vehicle production. The unemployment rate climbed more than anticipated to 5% over the three months to September, the highest level in four years. Payroll numbers fell, and wage growth moderated to 4.6%. This evidence of labour market softening has heightened the probability of a Bank of England rate cut in December. The shrinking workforce also signals weaker tax revenues, intensifying the budget's challenges and the risk of tighter spending to avoid market backlash. However, the Office for Budget Responsibility (OBR) has marginally upgraded its forecasts for the UK economy, giving the Chancellor a little more room to manoeuvre. These improved projections mean the government may have slightly higher tax revenues, which could help soften the impact of difficult budget decisions. UK equities held steady in this environment, with the FTSE All Share Index ticking up +0.3% and the more domestically oriented FTSE 250 matching that gain at +0.3%.

Japan stood out for its resilience, with the MSCI Japan advancing +1.1% amid broader global jitters. While AI concerns weighed on the Japanese tech sector, policy expectations under the new Prime Minister Sanae Takaichi provided a boost. She is expected to pursue pro-growth policies and favour a more cautious approach to raising interest rates by the Bank of Japan. Europe also delivered a strong performance, with the MSCI Europe ex-UK index rising by +2.9% over the week.

In the US, the 43-day government shutdown ended mid-week with House approval of funding through January, averting deeper disruption but revealing the backlog of delayed data, such as the much-anticipated September jobs report, which will be released on 20th November. Initial relief faded, and volatility increased as investors awaited the release of backlogged economic data and started to question the sustainability of the AI boom. Major tech names were hit hard, including Nvidia, which ended the week down -4.5% as investors grew concerned about valuations and what level of return companies will earn on the staggeringly large investments in AI. The S&P 500 ended the week up +0.2% but the tech-heavy Nasdaq 100 index fell -0.1% over the week, reflecting concerns on AI tech-stocks names.

Overall, the week laid bare vulnerabilities in tech dominance and the uneven path of policy normalisation, even as monetary tailwinds offered some offset. In this fluid setting, a diversified and disciplined investment approach remains the preferred approach to mitigating risks and capturing opportunities.

All performance figures are stated in Sterling terms, unless otherwise specified.

Any opinions stated are honestly held but are not guaranteed and should not be relied upon.

The information contained in this document is not to be regarded as an offer to buy or sell, or the solicitation of any offer to buy or sell, any investments or products.

The content of this document is for information only. It is advisable that you discuss your personal financial circumstances with a financial adviser before undertaking any investments.

All the data contained in the communication is believed to be reliable but may be inaccurate or incomplete. Unless otherwise specified all information is produced as of 17th November 2025.

© 2025 YOU Asset Management. All rights reserved.