MIFIDPRU 8 Disclosures 2024

Background

The Investment Firms Prudential Regime (IFPR) sets the FCA’s rules for MIFID investment firms and aims to ensure Financial Services businesses maintain sufficient capital to sustain their business. IFPR came into effect on 1st January 2022, and its provisions apply to YOU Asset Management as an FCA authorised and regulated firm.

The IFPR contains public disclosure requirements as set out in MIFIDPRU 8 and, for the financial year ending in 2024, YOU must meet the following rules:

- the disclosure requirements (MIFIDPRU 8.1)

- risk management objectives and policies (MIFIDPRU 8.2)

- disclosure of Governance arrangements (MIFIDPRU 8.3)

- own funds (MIFIDPRU 8.4)

- own funds requirements (MIFIDPRU 8.5), and

- remuneration policies and practices (MIFIDPRU 8.6)

Reporting Dates

Unless otherwise stated, all figures are taken from the firm’s audited accounts which were dated 30th June 2024, the firm’s financial year end, prior to being audited. MIFIDPRU 8 disclosures are published annually to align with the Annual Report and Accounts.

Risk Management Objectives and Policies (MIFIDPRU 8.2)

YOU operates a Risk Management Framework (RMF) and supporting processes which ultimately report into the Board of the YOU Investment Group. A committee structure, which was designed by the Chief Executive Officer, reports to the Board and ensures that procedures, controls and limits are consistent with our risk appetite.

The RMF sets out the key components of the Group’s risk management system. It is intended to provide a practical guide to help all staff better manage risks and to promote the appropriate culture within all the Group’s businesses.

It does this by providing a common language and clarity over responsibilities for managing risk, making it clear that we manage risks in order to achieve our ultimate objective as the YOU Investment Group. It sets out an approach to risk management intended to avoid some of the common pitfalls seen in risk management in many organisations.

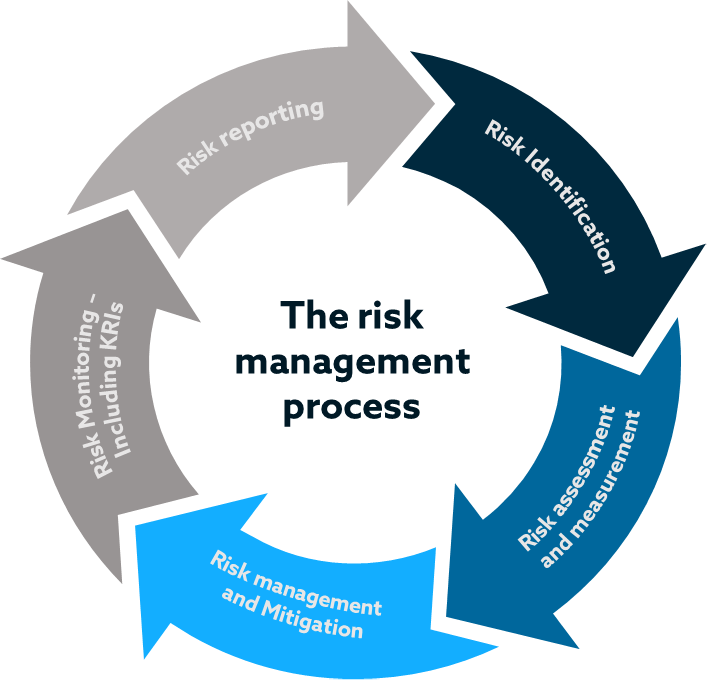

The risk management process has five key elements:

- Risk identification – The process of identifying the risk and capturing the risk

- Risk assessment and measurement – Assessing the materiality of the risk, what is the impact should the risk manifest

- Risk management and mitigation – Managing the risk on an ongoing basis and implementing controls to mitigate the risk e.g. Implementing the T&C scheme to ensure advisers have a desired level of competency

- Risk monitoring – including Key Risk indicators (KRIs) – Ongoing monitoring & oversight of the risk e.g. Monitoring of total client complaints

- Risk reporting – The documenting of the above and reporting into the defined governance arrangements e.g. Quarterly reporting to Audit & Risk Co or monthly reporting to the Executive Committee

Risk Categories

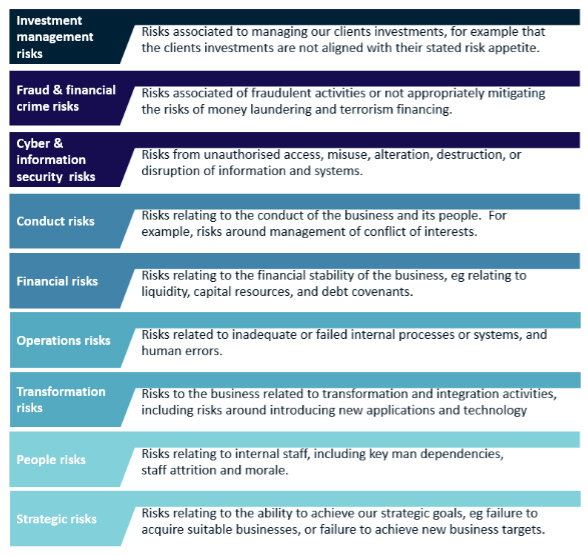

To help identify and manage risks, the Group Chief Risk Officer has set out the key risk areas within the RMF which are categorised as:

Governance Arrangements (MIFIDPRU 8.3)

YOU maintains a governance structure which clearly defines responsibilities across the business. This works towards delivering good outcomes for clients while also producing long term shareholder value.

The directors collectively possess a broad range of skills, backgrounds, experiences and knowledge appropriate for the effective oversight of the company’s business. Further to this, the YOU Investment Group employs a Non-Executive Director to scrutinise and challenge the decisions of the Executive Directors and senior management who update the Board on the company’s performance against its strategic objectives at Board meetings.

Good corporate governance encourages:

- an appropriate culture across the business

- clear accountability

- effective and transparent decision making

- protection of the interests of clients; and

- support to the strategy and business model

Directorships

The following information relates to the appointments of members of the management body in both executive and non-executive roles including directorships at organisations within the YOU Investment Group.

Table 1: Directorships Data is correct as of 31st December 2024

| Director | Position | Directorships (non-associated companies) | Directorships (associated companies) |

| Derrick Dunne | Chief Executive Officer | 0 | 3 |

| Peter Griffin | Investment Operations Director | 0 | 6 |

| Darren Sharkey | Chief Finance Officer | 0 | 34 |

| Steven Poulton | Compliance Director | 0 | 3 |

| Phil Wagstaff | Non-Executive Director | 0 | 1 |

Own Funds (MIFIDPRU 8.4)

Own Funds Capital Calculation

The table below shows the capital resources held by YOU Asset Management at its most recent reporting date, 30th June 2024.

In compliance with MIFIDPRU requirements, the following tables shows the composition of our Own Funds and a reconciliation to the capital in our audited financial statements.

Table 2: Composition of Regulatory Own Funds (MIFIDPRU 8.4.1)

| Item | Amount (£’000s) |

Source based on reference numbers/letters of the balance sheet in the financial statements |

|

| 1 | OWN FUNDS | 8,240 | |

| 2 | TIER 1 CAPITAL | 8,240 | |

| 3 | COMMON EQUITY TIER 1 CAPITAL | 8,240 | |

| 4 | Fully paid up capital instruments | – | |

| 5 | Share premium | 250 | Note 23 |

| 6 | Profit and loss account | 7,990 | Note 23 |

| 7 | Accumulated other comprehensive income | – | |

| 8 | Other reserves | – | |

| 9 | Adjustments to CET1 due to prudential filters | – | |

| 10 | Other funds | – | |

| 11 | (-)TOTAL DEDUCTIONS FROM COMMON EQUITY TIER 1 |

– | |

| 19 | CET1: Other capital elements, deductions and adjustments |

– | |

| 20 | ADDITIONAL TIER 1 CAPITAL | 0 | |

| 21 | Fully paid up, directly issued capital instruments | – | |

| 22 | Share premium | – | |

| 23 | (-) TOTAL DEDUCTIONS FROM ADDITIONAL TIER 1 | 0 | |

| 24 | Additional Tier 1: Other capital elements, deductions and adjustments |

– | |

| 25 | TIER 2 CAPITAL | 0 | |

| 26 | Fully paid up, directly issued capital instruments | – | |

| 27 | Share premium | – | |

| 28 | (-) TOTAL DEDUCTIONS FROM TIER 2 | 0 | |

| 29 | Tier 2: Other capital elements, deductions and adjustments |

– |

Table 3: reconciliation of regulatory own funds to balance sheet in the audited financial

statements

| Balance sheet as in published / audited financial statements(£000’s) |

Cross-reference to Table 2 (above) |

||

| As at period end | |||

| Fixed Assets: | |||

| 1 | Tangible Assets | 5 | |

| Current Assets: | |||

| 2 | Trade debtors | 7 | |

| 3 | Debtors amounts falling due within one year | 8,438 | |

| 4 | Cash at bank | 426 | |

| Total Assets | 8,876 | ||

| 1 | Creditors | 207 | |

| 2 | Accruals | 420 | |

| 3 | Provision | 9 | |

| Total Liabilities | 636 | ||

| Net Assets | 8,240 | Item 1 | |

Own Funds Requirements (MIFIDPRU 8.5)

The table below shows the three areas which determine our Own Funds Requirement. It is important that we hold capital in excess of the highest number in the below table which are broadly defined as:

- Fixed Overheads Requirement – This figure is 25% of our annual fixed expenditure which is the sum required by our regulator.

- K-Factor – Assets Under Management (K-AUM) – This figure is a calculation provided by our regulator which ensures we hold capital which is proportional to the amount of money we manage for our clients.

- Wind Down Trigger – This number is determined by our Wind Down Plan and shows the level of capital below which we would need to consider winding down the business.

Table 4: Own Funds Calculations

| Risk Calculation | Amount (£’000s) |

| Fixed Overheads Requirement | 883 |

| K-AUM | 433 |

| Wind-Down Trigger | 883 |

As a result, YOU’s Own Funds requirement is to maintain capital of £883,000 which is comfortably below the level of capital we hold.

Approach to Assessing the Adequacy of Own Funds

YOU implements an Internal Capital Adequacy and Risk Assessment process (the ICARA process) as its core financial risk management process. This provides an ongoing and continuous assessment of the controls we implement to minimise the potential harms our clients may face as a result of our ongoing business or in the event of wind-down. The ICARA process is completed by the Risk & Compliance Team but is reported to, and reviewed by, the highest level of management within the business. Key details are also forwards to our regulator, the FCA, to ensure we meet their expectations fully.

In completing our most recent assessment, we were able to satisfy our managing body and our regulator that we hold sufficient capital and liquid resources to address any potential harms presented by our business.

Renumeration Policy and Practices (MIFIDPRU 8.6)

Approach to Remuneration

YOU has a Remuneration Policy which aims to reward performance whilst maintaining robust risk management. The policy is aligned to the business strategy and values which are broadly to deliver long-term growth for our client.

The Remuneration Committee

To achieve this objective, the business maintains a very simple remuneration structure which is overseen by a remuneration committee which contains non-Executive Directors who balance our risk profile with our need to recruit and retain high calibre staff.

Responsibilities of the remuneration committee include:

- Monitoring the performance of the CEO and Executive Team against the business objectives

- Reviewing new hires within the Executive Team

- Approving Pay, Bonus and Benefits for the Executive Team and across the business

- Agreeing the general framework of staff bonus schemes within which the CEO will operate his delegated authority

Remuneration and Performance

YOU aims to offer attractive rewards to its staff to ensure it remains competitive in the market and rewards the performance of its people. Our remuneration scheme is very simple and consists of a combination of fixed and variable remuneration. These two elements are summarised as:

- Fixed Remuneration – This is the basic salary plus other benefits such as private medical insurance and contributions towards a pension scheme. Salaries reflect each person’s role within the company whereas our benefits package is harmonised across all staff to ensure equality.

- Variable Remuneration – There are two types of variable remuneration which are individual bonuses and, for certain senior employees, entry to a Management Incentive Plan which allows staff to invest in shares of the business. Bonuses reflect the performance of the individual and the business.

Balancing Fixed and Variable Remuneration

Variable remuneration is determined by assessing factors including the financial results of the company, the individual’s performance and adherence to compliance and regulatory obligations. Bonus payments are at the discretion of the remuneration committee, but variable remuneration is capped at a limit well below the FCA’s limits.

Management Incentive Plan

The purpose of our Management Incentive Plan is to align the interests of our senior employees with that of our investors and other stakeholders. These allocations are focused on motivating and rewarding sustained long-term performance. Long term incentives also serve to attract, motivate, and retain key senior employees.

Aggregate Remuneration

YOU has not disclosed information on the remuneration split into categories of senior management and other material risk takers to prevent the identification of any individuals within the business.

| Number of Senior Managers and Material Risk Takers | 9 |

| · Total Fixed Remuneration | £1,034,705 |

| · Total Variable Remuneration | £325,502 |

| Total number of staff (excluding those above) | 35 |

| · Total Fixed Remuneration | £1,218,016 |

| · Total Variable Remuneration | £158,500 |

Basis of Disclosure

This report is prepared on an accounting individual basis and includes the following regulated entity, YOU Asset Management (FRN 543459). The report is not required to be reviewed by the firm’s auditor. Certain information may have been omitted from the report if, in the opinion of the management of YOU, such information is of proprietary nature, price-sensitive, may intrude the privacy of any of the firm’s clients and employees, or would not change or influence the assessment or decision of market participants or other users of the report. The disclosed information is proportionate to the firm’s size and organisation, and to the nature, scope and complexity of its activities.