The World In A Week - Much Of The Same

Politics, trade wars and mixed data took up headlines last week.

Away from politics in the US and Europe, Hong Kong’s pro-democracy party won 85% of seats at the local elections, more than trebling the number of seats that they won in 2015. Turnout was also significantly higher at 71%, up from 47% in 2015. According to sources in Hong Kong, 17 councils out of a total of 18 will now be controlled by pro-democracy councillors. Local elections are normally of little interest, but these polls were the first time people were able to express their opinion over how the crisis in Hong Kong has been handled.

Several days later, and never one to be out of the limelight for long, Trump defied China when he signed the Hong Kong Rights & Democracy Act into law; the agreement effectively supports demonstrators and was condemned by China’s foreign ministry. In recent weeks, the US-China trade deal was on target to reach phase-1. However, Trump’s latest move will likely strain relations, making it difficult to finalise a trade truce. Regardless, the US equity market hit another all-time high.

Data in China last week was broadly positive, providing a fillip to global equity markets; one pocket of disappointment was industrial profits, which fell to 9.9% on an annualised basis, the worst contraction since 2011. Retail sales in both Japan and the US showed signs of weakness; in Japan sales fell c.7% year-on-year following a VAT hike. European data bucked the trend; manufacturing showed signs of stabilisation and French consumer confidence was better than expected at 106.

The World In A Week - Pavlov's Dogs

Last week gave us nothing new to ruminate on; it was a week of recycling the same political stories of trade deals, impeachments and elections.

The stock markets around the world reacted favourably to constructive discussions around the ‘phase one’ trade deal between the US and China. We find It interesting to note how the same piece of news can continue to elicit positive stock market reactions. The two dark linings to this silver cloud are the proposed 15% tariff hike on $160 billion of imports from China, set for 15th December, and the bill passed by the US Senate that requires the US State Department to annually assess Hong Kong’s autonomy.

The latter has drawn criticism from China, who has threatened retaliation if the bill becomes law, although they have not confirmed in what form the retaliation will take. The former does seem less of a stumbling block and could be used as an important distraction for President Trump, as the impeachment process continues unabated.

Two weeks of impeachment hearings have certainly been damaging for President Trump, with claims from witnesses that he pressured Ukraine to probe his potential political opponents. It is clear the Democrats are keen to impair the presidential election campaign for Trump, but it is also clear that this episode has solidified the Republican support for him.

In the UK, our own general election went up several gears, with televised debates between the main political parties and the launch of their manifestos. Now the dust has settled, not much has changed in the polls. According to YouGov Labour supporters favour Corbyn, while Conservative supporters favour Johnson. Those floating voters remain floating.

Experience has taught us not to make early conclusions, as with past elections and referendums, the polls have been a poor indicator of the actual outcome. We still have 17 campaigning days left until voting day and the doors behind this year’s advent calendar are sure to have some surprises.

The World In A Week - Never A Dull Moment

While violent clashes and political rhetoric filled the airwaves last week, markets were considerably more sedate. The Pound Sterling rose against all major global currencies. It appears the markets prefer the possibilities of a Conservative majority government as indicated in the polls to a hung parliament or Corbyn government. This left global equity indices marginally down in Sterling terms, with MSCI ACWI losing -0.44%. Global bonds hedged to Sterling were up marginally, with Barclays Global Aggregate up +0.37%.

Forces driving markets included the stalling of ongoing US-China trade talks, but sentiment remains sanguine that a deal will be reached with some roll back in tariffs forming part of this. Otherwise, the world’s attention turned to the various protest movements taking place across the globe. The situation in Hong Kong continues to deteriorate, as stunning footage emerged over the weekend of police being met with a barge of Molotov cocktails as they tried to clear protesting students out of a university. The risk of a Beijing-orchestrated crackdown remains high. Social unrest is also being experienced across South America, particularly in Chile, Bolivia and Ecuador. Venezuela remains dire and there is speculation that unrest could spread to Columbia too.

An inconclusive election result in Spain and dormant political risk in Italy caused peripheral European government bonds to sell off slightly – which had been a popular investment amongst fixed income managers recently. Saudi Arabia are continuing to press on with the IPO of Aramco – the state-owned oil company. It will be interesting to see how the growing focus from investors on ESG factors influence this process.

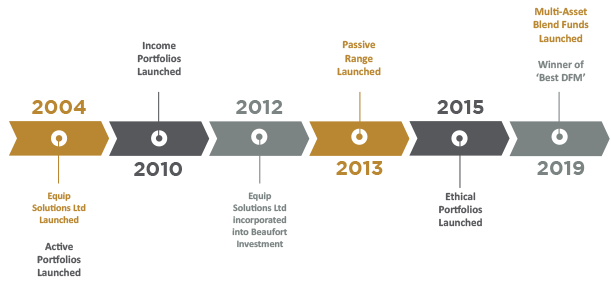

We've been at it for 15 years!

- We developed our investment range over the years to include Active, Enhanced Passive, Income and Ethical portfolios, together with Multi-Asset Blend Funds

- Our CIO has been with us since inception

- Continually developing the investment process

- Proud of our jargon-free communications

- Regular seminars, quarterly reviews, monthly fact sheets

For further information, please get in touch with Tony Hicks: 07867 398388 or email us at marketing@beaufortinvestment.co.uk

The World In A Week - Is This The Beginning Of The End?

The election machines for the main political parties rolled into action last week, and with just 31 days until the general election, politicians are keen to get their messages across, while taking carefully worded pot-shots at the opposition.

This meant that Parliament was officially dissolved on Tuesday so electioneering could commence the following day. However, the relief from Brexit and UK politics will be short-lived, as whatever the outcome of the general election, uncertainty will continue to prevail for the UK.

According to YouGov’s political tracker, the Conservatives lead in the poll with 39%, while Labour sits second with 26%, up from 21% at the beginning of the month. It should come as no surprise, that with 59% of the poll, the most important issue to voters is Britain leaving the EU.

If the polls are correct, which based on recent experience is wildly optimistic, then we may see a Conservative majority. That could mean Brexit takes place on or before 31st January 2020. The uncertainty here is the original transition period is due to finish at the end of 2020, which does not give much time to complete a comprehensive trade deal with the EU. Anything other than a Conservative majority would bring the uncertainty around Brexit front and centre.

Trade is also in the headlines across the Atlantic, with both the US and China having confirmed that if a phase one trade agreement happens, then it would include some reductions in tariffs. Whether this is a reduction in the actual tax rate or in the number of goods being taxed, was unclear. However, the time being taken around the negotiations does suggest a significant deal is in the pipeline.

It would seem the timing is equally convenient for both Presidents; one needs a good story to tweet about as his impeachment gains momentum, while the other needs to replenish his countries pork reserves. According to UBS China’s pork prices have soared 100% over the past 12 months, as the country has had to cull its pigs in the face of African Swine Fever. Pork is the most consumed meat in China and its importance cannot be understated.

The World In A Week - The New Boss, Same As The Old Boss?

It was a relatively sedate week in financial markets, as Sterling strengthened against most major global currencies. Equities were up slightly in GBP terms, while Fixed Income also rose by +0.25% in GBP hedged terms. Brexit related metrics were largely unchanged, as markets await the results of the forthcoming festive election. Global bonds maintained their gains vs Sterling bonds, as did domestically-focused UK equities vs their more international peers. The Dollar has begun to weaken against its main trading partners, which has given a nice boost to our local currency emerging market debt holdings.

One of the major developments in the world of finance was the changing of the guard at the European Central Bank. Christine Lagarde took over the position of President of the ECB from Mario Draghi. She begins her tenure at a time when storm clouds gather over the Eurozone economy and the monetary policy tools at her disposal are less and less effective at boosting economic growth. In that sense, Mr Draghi may have picked an opportune time to depart, as much of Madame Lagarde’s political capital will likely be expended in trying to convince the creditor nations of the Eurozone (namely Germany) to enact a fiscal stimulus to pick up the reins from monetary policy. This is not a task many would envy…

The World In A Week - On, and On and On...

Brexit shenanigans dominated the headlines last week as the UK’s departure from the EU drags on, and on, and on. While Prime Minister Johnson eventually reached a majority agreement, it failed to go to a vote in the House of Commons over the weekend as MPs deemed the narrow window of, 3 days, too narrow. The EU will now decide on allowing a further delay beyond the deadline of 31st October. In the meantime, Johnson has called for elections to be held on 12th December, the last day that community halls and other social spaces are available before the festive period; a two-thirds majority would be required for the vote to go ahead.

Central banks held little surprises; in his last appearance as Chair of the ECB, Mario Draghi remained dovish in his final address. While Draghi will formally hand over the reins to his successor this week, we look back to his famous speech in 2012, where he promised to do “whatever it takes” to save the Euro and he will leave the ECB having achieved this. In the week ahead, the US Federal Reserve meets on 29th, consensus is that there will be a further cut to interest rates.

Economic data last week was mixed; the Eurozone edged marginally higher from a reading of 50.1 in September to 50.2 in October, hanging on the expansionary territory, however, underlying data showed that France had done better than expected while Germany continues to slow. In the US, PMI preliminary data moved up from 51 to 51.2, despite disappointing durable goods orders.

Results season in the US was more positive; with a third of companies’ data now available, over 80% surprised to the upside pushing growth rates cautiously in to positive territory. It was a similar story in Europe, with more positive surprises than negative news, however, growth struggled and was marginally negative.

The World In A Week - Nine Lives

Another week where politics dominated the markets. It started with news that the US and China had reached a ‘phase one’ trade agreement, which boils down to being a truce. For the time being the US has agreed to suspend the increases in tariffs and China has agreed to increase their agricultural purchases. The key date is the Asia Pacific Economic Cooperation (APEC) summit in mid-November, where the deal is set to be concluded.

It is good news that the trade war is de-escalating, however we do expect further bumps along the way, especially as the US has just passed legislation supporting the pro-democracy protests in Hong Kong. Will this political disagreement complicate the delicate trade negotiations?

When it comes to complicated, the UK is building a monopoly. Having already lost eight commons votes since becoming Prime Minister, Boris Johnson made it nine with defeat on Saturday, a record not seen since Lord Rosebery in 1894.

Without the will of the politicians, any deal is doomed to failure. The addiction to avoid decision has become the modern malaise and with the narrow defeat on Saturday, Boris Johnson was forced to write to the EU to request an extension to Article 50. Even that simple task was laced with confusion and ulterior motives.

What we do know, is that geopolitics is not going to get any clearer any time soon. We know we have a US Presidential election next year, but the outcome is far from clear. While in the UK, we do not know what next year has in store; a referendum, a general election or some clarity over our exit from the EU?

That is why our investments continue to be appropriately diversified in these interesting times.

The World In A Week - Inching Towards A Deal

It was a rather lively week in financial markets, from the perspective of a UK-based investor. Sterling strengthened considerably against all major currencies, as markets anticipated a break-through in the long march to a Brexit deal. As Sterling strengthened, Global Equities as measured by MSCI ACWI were down -2.7% in GBP terms and the FTSE All Share index of UK Equities rose +1.61%. On the Fixed Income side of our portfolios, Global Bonds hedged to GBP returned -0.9% - but this considerably outperformed Sterling Bonds which returned -1.75% for the week.

Market developments were primarily driven by tentative advances in negotiations surrounding two prospective deals. Of major global importance, is the ongoing trade dispute between China and the US. Markets reacted favourably to news on Friday that the US had agreed a limited “phase one” trade deal with China which would delay tariff increases scheduled for this week. The agreement was positive, but light on detail and is widely seen as a truce in the ongoing trade war.

Closer to home, an outburst of optimism regarding the possibilities of a Brexit deal shot through financial markets towards the end of the week. The Irish Taoiseach, Leo Varadkar, met with Boris Johnson in 11th hour talks. Much was made of the reaffirmation of the possibility of a Brexit deal, even at this late stage. Sterling and UK assets rallied strongly on the news, and we expect volatility to persist into next week following the Queen’s speech on Monday.

The World In A Week - Entering The Final Furlong Of 2019

The sustained rise in the value of Sterling vs other major global currencies was the main story of the last week from the perspective of a UK-based investor, much as it has been for the year to date. The US Dollar was down -1.3% vs Sterling last week (-2.8% for the year to date) while the Euro was down -1.1% (-6.1% for the year to date).

Mr Market clearly “likes” the idea of a Tory majority capable of passing Johnson’s Brexit deal. We have not just seen this in the currency market, Global Bonds have outperformed Sterling bonds since we launched our MAB Funds in July and domestically-focused UK Equity has strongly outperformed firms listed in London but with little UK economic exposure over the same period. This is a strong reversal of the trends we have seen over the last four years.

Across other Equity asset classes, Emerging Markets and Japanese Equity have been the only positive contributors over the last month, but we should take this opportunity to reflect on how strong returns have been this year across both Equity and Fixed Income. The MSCI ACWI Index of Global Equities is up +19.2% in GBP terms, while the Bloomberg Barclays Global Aggregate Bond Index is up +6.5% when hedged to GBP. As investors, it is probably wise to brace ourselves to the reality that these exceptional returns across asset classes are unlikely to be replicated in 2020.